For more than a hundred years AMC Entertainment Holdings Inc. (NYSE: AMC) has been maintaining its position as a major corporation in the movie theater business. It continues to attract investors especially retail traders because it navigates financial issues as well as challenges caused by streaming services.

The assessment examines AMC’s financial standing along with market patterns and predicts stock valuation from 2024 to 2030 and investigates future market development afterward 2030.

So, where is AMC headed? Will the company recover its former strength or will it disappear from existence? Our study consists of three main points:

✅ AMC’s market cap history over the last 10 years

✅ Stock price predictions for 2024-2030

✅ How AMC compares to other entertainment stocks

✅ Analysts’ recommendations

✅ A technical indicator-based stock analysis

✅ Whether It is worth buying today

Let’s dive in!

Company Overview

Its Entertainment Holdings Inc. operates from its headquarters in Leawood Kansas to become the top theater chain worldwide. Since it operates in both the United States and Europe AMC Entertainment Holdings Inc. has become a prominent player in the entertainment business.

Financial problems at the company have worsened because of the COVID-19 pandemic and its high debt combined with diminishing theater visitor numbers caused by streaming services becoming popular.

It continues to push revenue diversification through premium theater programs and exclusive video content and by entering the residential popcorn business sector.

AMC’s Financial Health

Key Financials (as of 2025)

- Market Cap: $1.61 billion

- Revenue (TTM): $4.44 billion

- Net Income: -$399 million (Loss)

- EPS (TTM): -$1.37

- 52-Week Stock Price Range: $2.38 – $11.88

- Debt: $4.05 billion

- Stock Analyst Consensus: Sell

The financial reports from AMC show heavy debt expenses together with chronic financial losses. AMC is trying to stabilize its finances while facing ongoing liquidity problems since the company holds extensive debt obligations.

Short-Term Stock Price Forecast (2024 – 2030)

The following five years will demonstrate the critical importance of stability recovery for its business operations.

2024 – 2025: Gradual Recovery

The financial analysts forecast a small revenue decrease for stock in 2024 which will transition into a 2025 revenue growth of 11.49% to reach $5.2 billion.

Experts anticipate a substantial 9.8% growth in stock price performance for 2025 which will elevate it to $4.09.

The company’s stock price may range from $4.00 to $7.00 in 2025 because of an anticipated impressive movie release schedule including Avatar 3, Jurassic World 4 & Mission: Impossible 8.

Gains may face restrictions through three main challenges involving increasing interest rates and decreasing box office revenue and streaming services competition.

2026 – 2030: Mixed Predictions

The future stock price projection for stock during 2026 through 2030 will be determined by its success in responding to shifting public behavior trends.

Future stock price projections show $7.38 as a likely high point that the company could reach by 2029 provided it meets its debt reduction targets alongside revenue diversification goals.

The continued financial instability may drive stock prices down to $0.85 according to certain projections that extend to 2030.

📉 Key Risk Factors:

- Theaters continue to struggle as streaming dominates.

- AMC’s debt burden remains high, impacting profitability.

- Investors lose interest, causing further stock declines.

📈 Bullish Factors:

- A strong movie lineup in the coming years.

- A potential rebound in theater attendance.

- Expansion into new revenue streams (home popcorn, premium theater upgrades).

🔮 Prediction for 2030:

Stock price could range between $0.85 and $6.50, depending on how well the company navigates its challenges.

Long-Term Stock Forecast (2030 – 2050)

Looking beyond 2030, AMC’s future depends on industry trends and its financial recovery.

- If it successfully adapts (e.g., exclusive theatrical releases, premium movie experiences), the stock could experience long-term growth.

- However, if theaters continue to lose ground to streaming platforms, AMC’s financial struggles may worsen, leading to further stock declines or even bankruptcy risks.

Some optimistic projections estimate a stock price of $259.61 by 2030—but this is highly speculative.

More realistic forecasts place its stock under $10 by 2030, unless a major transformation occurs.

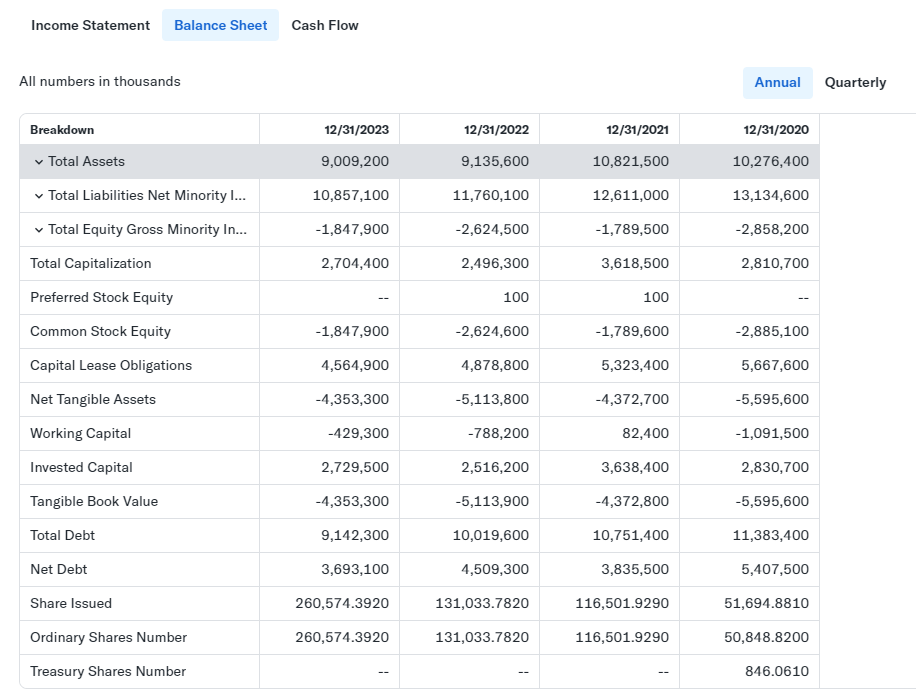

Balance Sheet & Liquidity Analysis

Its balance sheet highlights its financial weaknesses:

- Total Assets: $8.32 billion

- Total Liabilities: $10.01 billion

- Shareholder Equity: -$1.69 billion (negative)

- Long-Term Debt: $4.05 billion

🔍 Key Takeaways:

- AMC is highly leveraged, making it vulnerable to economic downturns.

- The company has negative shareholder equity, indicating higher financial risk.

- Liquidity is weak, with a high debt load relative to cash reserves.

Unless AMC dramatically reduces debt and boosts profitability, the stock will likely remain under pressure.

Final Thoughts: Should You Invest ?

Stock remains one of the most unpredictable stocks on the market.

💡 Reasons to Be Optimistic:

✔️ AMC is working on new revenue streams beyond ticket sales.

✔️ The box office is recovering, which could improve earnings.

✔️ The company is still a popular retail stock, attracting investors.

⚠️ Major Risks:

❌ AMC’s debt is overwhelming, making profitability difficult.

❌ The movie theater industry is declining, challenged by streaming services.

❌ The stock remains highly volatile, making it a risky bet.

Verdict:

📉 AMC is still a “high-risk, high-reward” stock. Investors should approach cautiously and consider long-term industry trends before investing.

Summary of Its Stock Price Predictions (2024-2030)

| Year | Stock Price Range (Low-High) | Key Factors |

|---|---|---|

| 2024 | $2.50 – $4.50 | High debt, declining revenue |

| 2025 | $4.00 – $7.00 | Box office recovery, new films |

| 2026 | $3.00 – $6.50 | Streaming competition, debt issues |

| 2027 | $2.50 – $5.50 | Financial restructuring needed |

| 2028 | $2.00 – $6.00 | Long-term outlook uncertain |

| 2029 | $1.50 – $7.38 | Possible turnaround or decline |

| 2030 | $0.85 – $6.50 | Industry trends will decide fate |

AMC’s Market Cap: A Decade of Highs and Lows

AMC’s market capitalization (market cap) tells a story of extreme volatility. It skyrocketed during the meme stock craze in 2021, only to crash back down in the following years.

Its Market Cap History (2013-2025)

| Year | Market Cap (in Billion USD) | Yearly Change (%) |

|---|---|---|

| 2013 | 1.99 | N/A |

| 2014 | 2.54 | +27.41% |

| 2015 | 2.33 | -8.31% |

| 2016 | 3.70 | +58.79% |

| 2017 | 1.92 | -47.97% |

| 2018 | 1.27 | -34.12% |

| 2019 | 0.75 | -40.83% |

| 2020 | 0.45 | -39.07% |

| 2021 | 13.97 | +2,951.53% |

| 2022 | 2.08 | -85.06% |

| 2023 | 1.51 | -27.37% |

| 2024 | 1.52 | +0.55% |

| 2025 | 1.35 | -11.25% |

🔍 Key Takeaways:

- The 2021 peak ($13.97B market cap) was driven by retail investor hype, not fundamentals.

- Since then, AMC has struggled to regain investor confidence due to financial challenges.

- In 2025, the market cap is down 11.25%, reflecting ongoing concerns about AMC’s future.

AMC Stock Price Trends: A Rollercoaster Ride

AMC’s stock has been on a wild journey, swinging between lows of $2.38 and highs of $11.88 in the last year. The company’s ability to stay relevant amid industry challenges will determine whether its stock recovers or crashes further.

Short-Term Predictions (2024-2030)

📅 2024-2025: A Slow Climb or More Declines?

- Analysts predict a modest 9.8% price increase in 2025, with a target of $4.09.

- The box office is expected to grow by 11%, boosted by major releases (Mission: Impossible 8, Jurassic World 4, Avatar 3).

- But debt remains a major problem, limiting AMC’s ability to reinvest in its business.

📅 2026-2030: Will AMC Survive?

- Bullish analysts say AMC could reach $7.38 by 2029—but this depends on strong box office performance and debt reduction.

- Bearish forecasts suggest AMC’s stock could drop as low as $0.85 by 2030, if the company fails to adapt to changing consumer habits.

AMC vs. Industry Peers: How Does It Compare?

Compared to other entertainment stocks, AMC is in a weaker position due to its high debt and profitability struggles.

| Company | Market Cap (Billion USD) | 2025 YTD Stock Change (%) |

|---|---|---|

| AMC Entertainment | 1.35 | -11.25% |

| Cinemark Holdings (CNK) | 2.1 | -5.4% |

| IMAX Corporation (IMAX) | 1.7 | +3.2% |

| The Walt Disney Company | 250 | +8.5% |

💡 Key Takeaways:

- Stock is struggling compared to Cinemark and IMAX.

- Disney is in a completely different league, with a diversified business beyond theaters.

- AMC still has brand power, but its financial health is a major concern.

What Do Analysts Say?

It is one of the most polarizing stocks in the market. While retail investors continue to support it, most Wall Street analysts are bearish.

| Analyst Firm | Recommendation | 12-Month Price Target (USD) |

|---|---|---|

| Fintel | Sell | 4.26 |

| CoinPriceForecast | Neutral | 4.78 |

| LongForecast | Sell | 1.55 |

| WalletInvestor | Strong Sell | 1.09 |

📉 Overall Verdict: AMC is a “Sell” according to analysts.

Technical Indicators: What the Charts Say

📊 Moving Averages → Bearish (It is below its 50-day and 200-day moving averages).

📊 RSI (Relative Strength Index) → Neutral (45) → Not oversold, but no buying momentum.

📊 MACD (Moving Average Convergence Divergence) → Bearish (Negative crossover suggests downward pressure).

Should You Buy AMC Stock?

🔥 Bullish Case (Why Stock Might Go Up):

✔️ The movie theater industry isn’t dead yet—strong box office numbers could help AMC recover.

✔️ AMC has a loyal retail investor base, which could push up the stock price.

✔️ If AMC reduces debt, profitability could improve.

⚠️ Bearish Case (Why stock Might Fall Further):

❌ High debt burden is a major risk.

❌ Streaming services continue to dominate, reducing theater attendance.

❌ AMC stock is highly speculative—it could crash just as easily as it could rise.

🚀 Final Verdict:

Investors face significant vulnerabilities but have the chance to earn substantial profits by purchasing AMC stock. It might be wise to consider a gambling-like purchase for temporary trading purposes. Those who invest for the long-term need to exercise caution due to higher risks than potential benefits.

Final Thoughts

Presently it faces an important decision point which could result in either resurgence or complete disappearance from the market. The company might survive through reinvention while adapting to modifications in the entertainment sector.

2025 Stock Price Forecast

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 3.79 | 3.79 | +1.9% |

| February | 2.96 | 3.79 | -20.4% to +1.9% |

| March | 2.83 | 3.33 | -23.9% to -10.5% |

| April | 2.85 | 3.35 | -23.4% to -9.9% |

| May | 3.10 | 3.86 | -16.7% to +3.8% |

| June | 3.57 | 4.44 | -4.0% to +19.4% |

| July | 3.84 | 4.50 | +3.2% to +21.0% |

| August | 3.98 | 4.68 | +7.0% to +25.8% |

| September | 4.28 | 5.02 | +15.1% to +35.0% |

| October | 4.43 | 5.21 | +19.1% to +40.1% |

| November | 4.55 | 5.35 | +22.3% to +43.8% |

| December | 4.73 | 5.55 | +27.2% to +49.2% |

2026 Stock Price Forecast

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 4.95 | 5.55 | +33.1% to +49.2% |

| February | 4.73 | 5.55 | +27.2% to +49.2% |

| March | 5.14 | 5.55 | +38.2% to +49.2% |

| April | 5.64 | 6.38 | +51.6% to +71.5% |

| May | 5.91 | 6.62 | +58.9% to +77.9% |

| June | 6.13 | 7.61 | +64.8% to +104.5% |

| July | 7.05 | 8.53 | +89.5% to +129.3% |

| August | 7.03 | 8.25 | +89.0% to +121.8% |

| September | 5.97 | 7.64 | +60.5% to +105.4% |

| October | 6.49 | 7.91 | +74.5% to +112.6% |

| November | 5.72 | 7.32 | +53.8% to +96.8% |

| December | 6.22 | 7.72 | +67.2% to +107.5% |

2027 Stock Price Forecast

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 7.15 | 8.88 | +92.2% to +138.7% |

| February | 6.43 | 8.22 | +72.8% to +120.9% |

| March | 6.99 | 8.68 | +88.0% to +133.3% |

| April | 6.28 | 8.04 | +68.8% to +116.1% |

| May | 6.83 | 8.10 | +83.6% to +117.7% |

| June | 7.07 | 8.31 | +90.1% to +123.4% |

| July | 6.46 | 7.69 | +73.4% to +106.7% |

| August | 6.25 | 7.33 | +67.8% to +97.0% |

| September | 6.79 | 8.43 | +82.8% to +126.6% |

| October | 7.81 | 9.70 | +110.0% to +160.8% |

| November | 7.81 | 9.17 | +110.0% to +151.1% |

| December | 6.64 | 8.49 | +78.5% to +128.2% |

How to Buy its Stock:

- Choose a Brokerage Account: Select a brokerage platform that offers access to the NYSE and supports trading of AMC shares.

- Open and Fund Your Account: Complete the necessary registration process and deposit funds into your account.

- To initiate your purchase search for AMC Entertainment Holdings, Inc. (usingTicker: AMC) and submit a buying order with the selected number of shares.

- Regularly check your investment along with monitoring company and market developments.

Final Disclaimer

The provided information serves an informational purpose yet it does not constitute financial advice. Before making investment choices you need to do personal research while talking with a financial advisor.

Frequency Asked Questions

What does AMC Entertainment Holdings, Inc. do?

AMC is the largest movie exhibition company in the United States, the largest in Europe and the largest throughout the world with approximately 900 theatres and 10,000 screens across the globe. AMC has propelled innovation in the exhibition industry by: deploying its Signature power-recliner seats; delivering enhanced food and beverage choices; generating greater guest engagement through its loyalty and subscription programs, website, and mobile apps; offering premium large format experiences and playing a wide variety of content including the latest Hollywood releases and independent programming. In addition, in 2023 AMC launched AMC Theatres Distribution with the highly successful releases of TAYLOR SWIFT | THE ERAS TOUR and RENAISSANCE: A FILM BY BEYONCÉ. It Theatres Distribution expects to release more concert films with the world’s leading musical artists in the years ahead.

When was AMC Entertainment Holdings, Inc. formed?

AMC Entertainment Holdings, Inc’s. business was founded in 1920.

How many theatres does AMC operate?

It is the largest movie exhibitor in the U.S., Europe, and the World. As of March 31, 2024, AMC owned or operated approximately 900 theatres and 10,000 screens across the globe.

Who are AMC Entertainment Holdings, Inc’s. auditors?

AMC’s independent registered public accounting firm is Ernst & Young LLP.

How do I invest in AMC Entertainment Holdings, Inc. common stock?

AMC Entertainment Holdings, Inc. does not currently provide a program that allows individual investors to purchase stock directly from the company. Computershare, our transfer agent, does provide a DirectStock program that facilitates additional market purchases by registered stockholders.

📢 Disclaimer:

This analysis functions as informational material with no purpose of delivering financial guidance. Make certain you perform individual research before starting to invest. 🚀

3 thoughts on “AMC Entertainment (NYSE: AMC) Stock Price Prediction & Analysis (2025-2030)”